-

Health Catalyst Reports First Quarter 2025 Results

Source: Nasdaq GlobeNewswire / 07 May 2025 15:03:00 America/Chicago

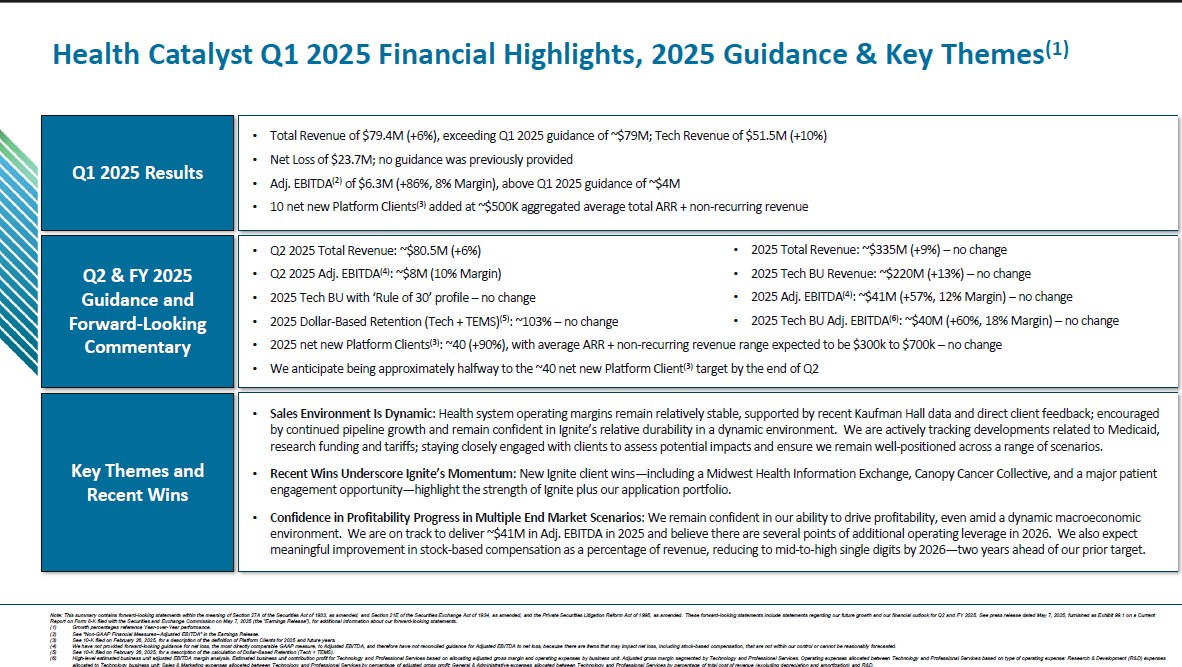

SALT LAKE CITY, May 07, 2025 (GLOBE NEWSWIRE) -- Health Catalyst, Inc. (“Health Catalyst,” Nasdaq: HCAT), a leading provider of data and analytics technology and services to healthcare organizations, today reported financial results for the quarter ended March 31, 2025.

“For the first quarter of 2025, I am pleased by our strong financial results, including total revenue of $79.4 million and Adjusted EBITDA of $6.3 million, with these results beating our quarterly guidance on each metric,” said Dan Burton, CEO of Health Catalyst. “Additionally, we are happy to share that we added 10 net new Platform Clients in Q1 2025. This is especially encouraging given that Q1 is typically a quieter bookings quarter, and this performance gives us increased confidence of hitting our target of 40 net new Platform Client additions in 2025.”

Financial Highlights for the Three Months Ended March 31, 2025

Key Financial Metrics

Three Months Ended March 31, Year over Year

Change2025 2024 GAAP Financial Measures: (in thousands, except percentages, unaudited) Total revenue $ 79,413 $ 74,723 6% Gross profit $ 28,659 $ 29,321 (2)% Gross margin 36 % 39 % Net loss $ (23,742 ) $ (20,587 ) (15)% Non-GAAP Financial Measures:(1) Adjusted Gross Profit $ 39,048 $ 38,319 2% Adjusted Gross Margin 49 % 51 % Adjusted EBITDA $ 6,279 $ 3,377 86% ________________________

(1) These measures are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). See the accompanying "Non-GAAP Financial Measures" section below for more information about these financial measures, including the limitations of such measures, and for a reconciliation of each measure to the most directly comparable measure calculated in accordance with GAAP.

Financial OutlookHealth Catalyst provides forward-looking guidance on total revenue, a GAAP measure, and Adjusted EBITDA, a non-GAAP measure.

For the second quarter of 2025, we expect:

- Total revenue of approximately $80.5 million, and

- Adjusted EBITDA of approximately $8 million

For the full year of 2025, we expect:

- Total revenue of approximately $335 million,

- Technology revenue of approximately $220 million, and

- Adjusted EBITDA of approximately $41 million

We have not provided forward-looking guidance for net loss, the most directly comparable GAAP measure to Adjusted EBITDA, and therefore have not reconciled guidance for Adjusted EBITDA to net loss, because there are items that may impact net loss, including stock-based compensation, that are not within our control or cannot be reasonably forecasted.

Quarterly Conference Call Details

We will host a conference call to review the results today, Wednesday, May 7, 2025, at 5:00 p.m. E.T. The conference call can be accessed by dialing (800) 343-5172 for U.S. participants, or (203) 518-9856 for international participants, and referencing conference ID “HCATQ125.” A live audio webcast will be available online at https://ir.healthcatalyst.com/. A replay of the call will be available via webcast for on-demand listening shortly after the completion of the call, at the same web link, and will remain available for approximately 90 days.

About Health Catalyst

Health Catalyst (Nasdaq: HCAT) is a leading provider of data and analytics technology and services that ignite smarter healthcare, lighting the path to measurable clinical, financial, and operational improvement. More than 1,000 organizations worldwide rely on Health Catalyst's offerings, including our cloud-based technology ecosystem Health Catalyst Ignite™, AI-enabled data and analytics solutions, and expert services to drive meaningful outcomes across hundreds of millions of patient records. Powered by high-value data, standardized measures and registries, and deep healthcare domain expertise, Ignite helps organizations transform complex information into actionable insights. Backed by a multi-decade mission and a proven track record of delivering billions of dollars in measurable results, Health Catalyst continues to serve as the catalyst for massive, measurable, data-informed healthcare improvement and innovation.

Available Information

Our investors and others should note that we announce material information to the public about our company, products and services, and other matters related to our company through a variety of means, including our website (https://www.healthcatalyst.com/), our investor relations website (https://ir.healthcatalyst.com/), press releases, SEC filings, public conference calls, and social media, including our and our CEO's social media accounts such as LinkedIn (https://www.linkedin.com/), in order to achieve broad, non-exclusionary distribution of information to the public and to comply with our disclosure obligations under Regulation FD.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements include statements regarding our future growth and our financial outlook for the second quarter and full year 2025. Forward-looking statements are subject to risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance.

Important risks and uncertainties that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) changes in laws and regulations applicable to our business model; (ii) changes in market or industry conditions, regulatory environment, and receptivity to our technology and services; (iii) results of litigation or a security incident; (iv) the loss of one or more key clients or partners; (v) macroeconomic challenges (including high inflationary and/or high interest rate environments, tariffs, or market volatility and measures taken in response thereto) and natural disasters or new public health crises; and (vi) changes to our abilities to recruit and retain qualified team members. For a detailed discussion of the risk factors that could affect our actual results, please refer to the risk factors identified in our SEC reports, including, but not limited to the Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2025, expected to be filed with the SEC on or about May 12, 2025, and the Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 26, 2025. All information provided in this release and in the attachments is as of the date hereof, and we undertake no duty to update or revise this information unless required by law.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share data, unaudited)As of

March 31,As of

December 31,2025 2024 (unaudited) Assets Current assets: Cash and cash equivalents $ 341,968 $ 249,645 Short-term investments — 142,355 Accounts receivable, net 64,046 57,182 Prepaid expenses and other assets 16,702 16,468 Total current assets 422,716 465,650 Property and equipment, net 31,648 29,394 Intangible assets, net 106,400 86,052 Operating lease right-of-use assets 11,877 12,058 Goodwill 313,380 259,759 Other assets 5,521 6,016 Total assets $ 891,542 $ 858,929 Liabilities and stockholders’ equity Current liabilities: Accounts payable $ 8,946 $ 11,433 Accrued liabilities 23,795 26,340 Deferred revenue 71,497 53,281 Operating lease liabilities 3,760 3,614 Current portion of long-term debt 231,563 231,182 Total current liabilities 339,561 325,850 Long-term debt, net of current portion 151,291 151,178 Deferred revenue, net of current portion 407 249 Operating lease liabilities, net of current portion 15,751 16,291 Contingent consideration liabilities, net of current portion 7,313 — Other liabilities 408 154 Total liabilities 514,731 493,722 Stockholders’ equity: Preferred stock, $0.001 par value per share; 25,000,000 shares authorized and no shares issued and outstanding as of March 31, 2025 and December 31, 2024 — — Common stock, $0.001 par value per share, and additional paid-in capital; 500,000,000 shares authorized as of March 31, 2025 and December 31, 2024; 69,481,638 and 64,043,799 shares issued and outstanding as of March 31, 2025 and December 31, 2024, respectively 1,587,085 1,552,714 Accumulated deficit (1,210,414 ) (1,186,672 ) Accumulated other comprehensive income (loss) 140 (835 ) Total stockholders’ equity 376,811 365,207 Total liabilities and stockholders’ equity $ 891,542 $ 858,929 Condensed Consolidated Statements of Operations

(in thousands, except per share data, unaudited)Three Months Ended March 31, 2025 2024 Revenue: Technology $ 51,482 $ 46,966 Professional services 27,931 27,757 Total revenue 79,413 74,723 Cost of revenue, excluding depreciation and amortization: Technology(1)(2)(3) 17,565 15,315 Professional services(1)(2)(3) 25,613 23,202 Total cost of revenue, excluding depreciation and amortization 43,178 38,517 Operating expenses: Sales and marketing(1)(2)(3) 14,738 19,058 Research and development(1)(2)(3) 15,186 14,871 General and administrative(1)(2)(3)(4) 14,162 14,564 Depreciation and amortization 12,320 10,525 Total operating expenses 56,406 59,018 Loss from operations (20,171 ) (22,812 ) Interest and other (expense) income, net (3,356 ) 2,338 Loss before income taxes (23,527 ) (20,474 ) Income tax provision 215 113 Net loss $ (23,742 ) $ (20,587 ) Net loss per share, basic and diluted $ (0.35 ) $ (0.35 ) Weighted-average shares outstanding used in calculating net loss per share, basic and diluted 68,552 58,592 _______________

(1) Includes stock-based compensation expense as follows:Three Months Ended March 31, 2025 2024 Stock-Based Compensation Expense: (in thousands) Cost of revenue, excluding depreciation and amortization: Technology $ 219 $ 365 Professional services 1,002 1,332 Sales and marketing 2,162 3,990 Research and development 1,133 1,844 General and administrative 3,027 3,307 Total $ 7,543 $ 10,838

(2) Includes acquisition-related costs, net, as follows:Three Months Ended March 31, 2025 2024 Acquisition-related costs, net: (in thousands) Cost of revenue, excluding depreciation and amortization: Technology $ 74 $ 65 Professional services 120 91 Sales and marketing 498 64 Research and development 167 202 General and administrative 2,170 391 Total $ 3,029 $ 813

(3) Includes restructuring costs as follows:Three Months Ended March 31, 2025 2024 Restructuring costs: (in thousands) Cost of revenue, excluding depreciation and amortization: Technology $ 401 $ 79 Professional services 997 181 Sales and marketing 352 449 Research and development 1,672 443 General and administrative 136 661 Total $ 3,558 $ 1,813

(4) Includes non-recurring lease-related charges as follows:Three Months Ended March 31, 2025 2024 Non-recurring lease-related charges: (in thousands) General and administrative $ — $ 2,200 Total $ — $ 2,200 Condensed Consolidated Statements of Cash Flows

(in thousands, unaudited)Three Months Ended

March 31,2025 2024 Cash flows from operating activities Net loss $ (23,742 ) $ (20,587 ) Adjustments to reconcile net loss to net cash provided by operating activities: Stock-based compensation expense 7,543 10,838 Depreciation and amortization 12,320 10,525 Impairment of long-lived assets — 2,200 Non-cash operating lease expense 735 781 Amortization of debt discount, issuance costs, and deferred financing costs 1,208 379 Investment discount and premium accretion (914 ) (1,965 ) Provision for expected credit losses 810 2,405 Deferred tax provision 67 14 Other (292 ) 4 Change in operating assets and liabilities: Accounts receivable, net (6,067 ) 4,011 Prepaid expenses and other assets 764 300 Accounts payable, accrued liabilities, and other liabilities (7,196 ) (5,495 ) Deferred revenue 15,988 7,801 Operating lease liabilities (944 ) (945 ) Net cash provided by operating activities 280 10,266 Cash flows from investing activities Proceeds from the sale and maturity of short-term investments 143,208 137,000 Purchase of short-term investments — (50,197 ) Acquisition of businesses, net of cash acquired (41,122 ) — Capitalization of internal-use software (4,661 ) (2,530 ) Purchase of intangible assets — (84 ) Purchases of property and equipment (670 ) (208 ) Proceeds from the sale of property and equipment 7 3 Net cash provided by investing activities 96,762 83,984 Cash flows from financing activities Proceeds from employee stock purchase plan 695 843 Proceeds from exercise of stock options — 20 Repurchase of common stock (5,000 ) — Repayment of debt (407 ) — Net cash (used in) provided by financing activities (4,712 ) 863 Effect of exchange rate changes on cash and cash equivalents (7 ) (19 ) Net increase in cash and cash equivalents 92,323 95,094 Cash and cash equivalents at beginning of period 249,645 106,276 Cash and cash equivalents at end of period $ 341,968 $ 201,370 Non-GAAP Financial Measures

To supplement our financial information presented in accordance with GAAP, we believe certain non-GAAP financial measures, including Adjusted Gross Profit, Adjusted Gross Margin, Adjusted EBITDA, Adjusted Net Income, and Adjusted Net Income per share, basic and diluted, are useful in evaluating our operating performance. For example, we exclude stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding our operational performance and allows investors the ability to make more meaningful comparisons between our operating results and those of other companies. We use this non-GAAP financial information to evaluate our ongoing operations, as a component in determining employee bonus compensation, and for internal planning and forecasting purposes.

We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. A reconciliation is provided below for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, and not to rely on any single financial measure to evaluate our business.

Adjusted Gross Profit and Adjusted Gross Margin

Gross profit is a GAAP financial measure that is calculated as revenue less cost of revenue, including depreciation and amortization of capitalized software development costs and acquired technology. We calculate gross margin as gross profit divided by our revenue. Adjusted Gross Profit is a non-GAAP financial measure that we define as gross profit, adjusted for (i) depreciation and amortization, (ii) stock-based compensation, (iii) acquisition-related costs, net, and (iv) restructuring costs, as applicable. We define Adjusted Gross Margin as our Adjusted Gross Profit divided by our revenue. We believe Adjusted Gross Profit and Adjusted Gross Margin are useful to investors as they eliminate the impact of certain non-cash expenses and allow a direct comparison of these measures between periods without the impact of non-cash expenses and certain other non-recurring operating expenses.

We present both of these measures for our technology and professional services business. We believe these non-GAAP financial measures are useful in evaluating our operating performance compared to that of other companies in our industry, as these metrics generally eliminate the effects of certain items that may vary from company to company for reasons unrelated to overall profitability.

The following is a calculation of our gross profit and gross margin and a reconciliation of gross profit and gross margin, the most directly comparable financial measures calculated in accordance with GAAP, to our Adjusted Gross Profit and Adjusted Gross Margin in total and for technology and professional services for the three months ended March 31, 2025 and 2024.

Three Months Ended March 31, 2025 (in thousands, except percentages) Technology Professional

ServicesTotal Revenue $ 51,482 $ 27,931 $ 79,413 Cost of revenue, excluding depreciation and amortization (17,565 ) (25,613 ) (43,178 ) Amortization of intangible assets, cost of revenue (4,596 ) — (4,596 ) Depreciation of property and equipment, cost of revenue (2,980 ) — (2,980 ) Gross profit 26,341 2,318 28,659 Gross margin 51 % 8 % 36 % Add: Amortization of intangible assets, cost of revenue 4,596 — 4,596 Depreciation of property and equipment, cost of revenue 2,980 — 2,980 Stock-based compensation 219 1,002 1,221 Acquisition-related costs, net(1) 74 120 194 Restructuring costs(2) 401 997 1,398 Adjusted Gross Profit $ 34,611 $ 4,437 $ 39,048 Adjusted Gross Margin 67 % 16 % 49 % ___________________

(1) Acquisition-related costs, net include deferred retention expenses attributable to the Upfront, Intraprise, ARMUS, and KPI Ninja acquisitions.

(2) Restructuring costs include severance and other team member costs from workforce reductions. For additional details, refer to Note 19 in our condensed consolidated financial statements.Three Months Ended March 31, 2024 (in thousands, except percentages) Technology Professional

ServicesTotal Revenue $ 46,966 $ 27,757 $ 74,723 Cost of revenue, excluding depreciation and amortization (15,315 ) (23,202 ) (38,517 ) Amortization of intangible assets, cost of revenue (4,371 ) — (4,371 ) Depreciation of property and equipment, cost of revenue (2,514 ) — (2,514 ) Gross profit 24,766 4,555 29,321 Gross margin 53 % 16 % 39 % Add: Amortization of intangible assets, cost of revenue 4,371 — 4,371 Depreciation of property and equipment, cost of revenue 2,514 — 2,514 Stock-based compensation 365 1,332 1,697 Acquisition-related costs, net(1) 65 91 156 Restructuring costs(2) 79 181 260 Adjusted Gross Profit $ 32,160 $ 6,159 $ 38,319 Adjusted Gross Margin 68 % 22 % 51 % ___________________

(1) Acquisition-related costs, net include deferred retention expenses attributable to the ARMUS and KPI Ninja acquisitions

(2) Restructuring costs include severance and other team member costs from workforce reductions. For additional details, refer to Note 19 in our condensed consolidated financial statements.Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that we define as net loss adjusted for (i) interest and other (income) expense, net, (ii) income tax provision, (iii) depreciation and amortization, (iv) stock-based compensation, (v) acquisition-related costs, net, (vi) restructuring costs, and (vii) non-recurring lease-related charges. We view acquisition-related expenses when applicable, such as transaction costs and changes in the fair value of contingent consideration liabilities that are directly related to business combinations, as costs that are unpredictable, dependent upon factors outside of our control, and are not necessarily reflective of operational performance during a period. We believe that excluding restructuring costs and non-recurring lease-related charges allows for more meaningful comparisons between operating results from period to period as these are separate from the core activities that arise in the ordinary course of our business and are not part of our ongoing operations. We believe Adjusted EBITDA provides investors with useful information on period-to-period performance as evaluated by management and a comparison with our past financial performance, and is useful in evaluating our operating performance compared to that of other companies in our industry, as this metric generally eliminates the effects of certain items that may vary from company to company for reasons unrelated to overall operating performance. The following is a reconciliation of our net loss, the most directly comparable financial measure calculated in accordance with GAAP, to Adjusted EBITDA for the three months ended March 31, 2025 and 2024:

Three Months Ended

March 31,2025 2024 (in thousands) Net loss $ (23,742 ) $ (20,587 ) Add: Interest and other (income) expense, net 3,356 (2,338 ) Income tax provision 215 113 Depreciation and amortization 12,320 10,525 Stock-based compensation 7,543 10,838 Acquisition-related costs, net(1) 3,029 813 Restructuring costs(2) 3,558 1,813 Non-recurring lease-related charges(3) — 2,200 Adjusted EBITDA $ 6,279 $ 3,377 __________________

(1) Acquisition-related costs, net include third-party fees associated with due diligence, deferred retention expenses, post-acquisition restructuring costs incurred as part of business combinations, and changes in fair value of contingent consideration liabilities for potential earn-out payments.

(2) Restructuring costs include severance and other team member costs from workforce reductions. For additional details, refer to Note 19 in our condensed consolidated financial statements.

(3) Non-recurring lease-related charges include the lease-related impairment charge related to our corporate office space designated for subleasing. For additional details, refer to Note 9 in our condensed consolidated financial statements.

Adjusted Net Income and Adjusted Net Income Per ShareAdjusted Net Income is a non-GAAP financial measure that we define as net loss adjusted for (i) stock-based compensation, (ii) amortization of acquired intangibles, (iii) restructuring costs, (iv) acquisition-related costs, net, including the change in fair value of contingent consideration liabilities, (v) non-recurring lease-related charges, and (vi) non-cash interest expense related to debt facilities. We believe Adjusted Net Income provides investors with useful information on period-to-period performance as evaluated by management and comparison with our past financial performance and is useful in evaluating our operating performance compared to that of other companies in our industry, as this metric generally eliminates the effects of certain items that may vary from company to company for reasons unrelated to overall operating performance. The following is a reconciliation of our net loss, the most directly comparable financial measure calculated in accordance with GAAP, to Adjusted Net Income, for the three months ended March 31, 2025 and 2024:

Three Months Ended

March 31,2025 2024 Numerator: (in thousands, except share and per share amounts) Net loss $ (23,742 ) $ (20,587 ) Add: Stock-based compensation . 7,543 10,838 Amortization of acquired intangibles 8,732 7,251 Restructuring costs(1) 3,558 1,813 Acquisition-related costs, net(2) 3,029 813 Non-recurring lease-related charges(3) — 2,200 Non-cash interest expense related to debt facilities . 1,208 379 Adjusted Net Income $ 328 $ 2,707 Denominator: Weighted-average shares outstanding used in calculating net loss per share, basic and diluted, and Adjusted Net Income per share, basic 68,552,084 58,591,514 Non-GAAP dilutive effect of stock-based awards 225,507 254,323 Non-GAAP weighted-average shares outstanding used in calculating Adjusted Net Income per share, diluted 68,777,591 58,845,837 Net loss per share, basic and diluted $ (0.35 ) $ (0.35 ) Adjusted Net Income per share, basic and diluted $ 0.01 $ 0.05 ______________

(1) Restructuring costs include severance and other team member costs from workforce reductions. For additional details, refer to Note 19 in our condensed consolidated financial statements.

(2) Acquisition-related costs, net includes third-party fees associated with due diligence, deferred retention expenses, post-acquisition restructuring costs incurred as part of business combinations, and changes in fair value of contingent consideration liabilities for potential earn-out payments.

(3) Non-recurring lease-related charges include the lease-related impairment charge related to our corporate office space designated for subleasing. For additional details, refer to Note 9 in our condensed consolidated financial statements.

Health Catalyst Investor Relations Contact:

Jack Knight

Vice President, Investor Relations

+1 (855)-309-6800

ir@healthcatalyst.comHealth Catalyst Media Contact:

Kathryn Mykleseth

Director, Public Relations and Communications

media@healthcatalyst.com

To view this slide as a PDF, please click here: http://ml.globenewswire.com/Resource/Download/1ceb6cba-a3ae-4d3d-812b-e0fefe6933e7